The United Kingdom power rental market is a rapidly expanding sector, driven by increasing demand for reliable and cost-effective power solutions across various industries. The market’s growth trajectory is being propelled by the rising need for temporary power sources in construction, events, industrial operations, and emergency power backup. With the market size reaching approximately USD 791.0 million in 2023, the UK power rental industry is expected to witness a steady growth rate, with a projected compound annual growth rate (CAGR) of 3.6% between 2024 and 2032, reaching an estimated value of around USD 1,090.6 million by 2032.

This article provides a comprehensive analysis of the UK power rental market, including its current status, key drivers, challenges, market trends, and growth opportunities. We will also explore the impact of various sectors and the role of technological advancements on market dynamics.

Overview of the UK Power Rental Market

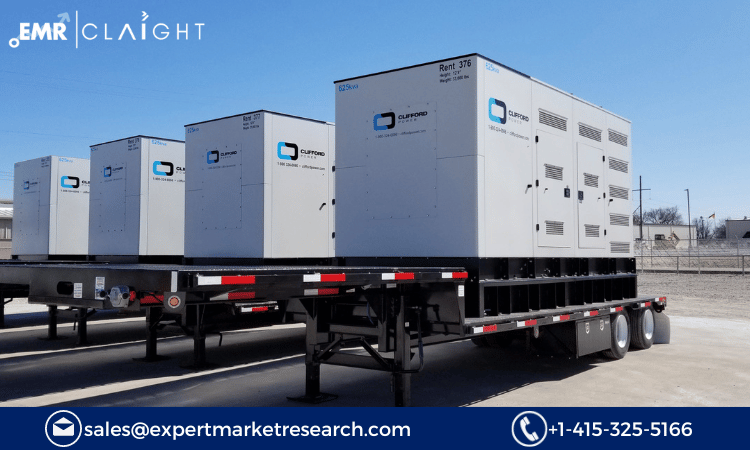

The UK power rental market refers to the temporary supply of electrical power through rented generators and power equipment. This sector serves as an essential component of several industries, including construction, manufacturing, entertainment, and telecommunications.

Power rental services offer a cost-effective and flexible solution to companies that require temporary or emergency power sources without the need for significant capital investment in infrastructure. The power rental market plays a vital role in ensuring operational continuity during power outages, supporting major projects, and assisting with large-scale events.

The key power rental solutions in the UK market include:

- Diesel Generators: Widely used for their efficiency and high output, particularly in industries with heavy power consumption needs.

- Gas Generators: As part of the shift toward greener power sources, gas-powered generators are gaining traction in the market.

- Hybrid Power Systems: These systems combine the efficiency of generators with renewable energy sources like solar power.

- Uninterruptible Power Supply (UPS) Systems: Critical for sectors that require continuous power without interruptions, such as data centers and healthcare facilities.

Get a Free Sample Report with Table of Contents

Market Drivers

Growing Demand for Temporary Power Solutions

One of the primary drivers for the power rental market in the UK is the increasing need for temporary power solutions. Industries involved in large construction projects, events, or those experiencing rapid growth in demand for electricity often turn to rental power sources. For example, the construction of new commercial and residential buildings or infrastructure projects often requires temporary electricity supplies during the building phase.

The event industry, which hosts festivals, concerts, and large corporate gatherings, also relies heavily on power rental solutions. Temporary power for events is needed to ensure that lighting, sound systems, and other crucial equipment are functional without depending on the local power grid.

Emergencies and Power Outages

Unforeseen power outages are another significant driver of the UK power rental market. Storms, equipment failure, and other issues can lead to extensive power interruptions. Power rental services are crucial in these situations, ensuring that businesses and critical infrastructure like hospitals, telecoms, and transport systems continue to operate during power failures.

According to the UK government’s National Grid, the country experienced several notable power outages in recent years, highlighting the need for backup power solutions. The increasing frequency of such disruptions is driving the demand for rental services, particularly in sectors that rely on continuous operations.

Technological Advancements in Power Solutions

Technological innovations have significantly enhanced the efficiency and environmental performance of power rental equipment. The development of hybrid power systems, which integrate renewable energy sources like solar or wind with traditional generators, is becoming increasingly popular. These systems offer a more sustainable power solution while reducing fuel costs and emissions.

Additionally, advancements in generator control systems, monitoring software, and real-time diagnostics are helping businesses optimise energy consumption, reduce downtime, and improve operational efficiency. These innovations are contributing to the growing adoption of rental power solutions across various industries.

Increased Awareness of Environmental Impact

With growing environmental concerns and stricter regulations on carbon emissions, businesses are looking for cleaner, more sustainable power alternatives. As a result, there has been an increasing shift towards cleaner fuels and hybrid systems that combine renewable energy sources with traditional generators. The ability to reduce carbon footprints while ensuring reliable power is a key selling point for power rental providers.

Market Challenges

Fuel Costs and Availability

Despite the growing demand for power rental solutions, fuel costs remain a significant challenge for the industry. Diesel generators, which remain one of the most commonly rented equipment, require regular refuelling. Fluctuations in fuel prices can increase the operating costs for companies in the rental business, making it more expensive for customers.

Moreover, fuel availability and the logistics of supplying fuel to remote or off-grid locations present challenges for power rental providers. For large-scale projects or during emergency situations, fuel delivery can be complex and time-consuming, which can delay the deployment of power rental services.

High Initial Investment

For power rental companies, the high upfront costs of purchasing and maintaining equipment represent a significant barrier to entry in the market. The acquisition, transportation, maintenance, and servicing of power equipment require substantial investment. Small and medium-sized enterprises (SMEs) may find it difficult to compete with larger firms that have more substantial financial resources to invest in fleet expansion.

Competition and Price Sensitivity

The power rental market is highly competitive, with numerous established and emerging players. Price sensitivity is a significant concern for customers, who often choose rental services based on cost-effectiveness. As a result, companies may face pressure to lower prices, which can reduce profitability. In this competitive environment, companies must offer superior services, reliability, and value-added features to stand out in the market.

Regulatory Compliance

Rental companies must comply with strict regulations concerning emissions, safety standards, and operational guidelines. As the government continues to tighten environmental regulations, power rental companies need to upgrade their fleets to meet stricter emission standards. This includes investing in low-emission, energy-efficient, and cleaner power solutions.

Key Market Trends

Shift Toward Clean and Renewable Energy

One of the most significant trends in the UK power rental market is the transition towards cleaner and more sustainable energy sources. While diesel generators remain popular due to their high reliability and efficiency, there is a growing shift towards hybrid power solutions that integrate solar, wind, and energy storage technologies.

Hybrid systems are gaining traction in industries that aim to reduce their environmental impact, such as the construction sector. Solar-powered generators and battery storage systems, combined with traditional generators, provide a greener solution that reduces fuel consumption and emissions.

Digitalisation and IoT Integration

The integration of digital technologies and the Internet of Things (IoT) is revolutionising the power rental industry. Remote monitoring and control systems allow customers to track power usage, generator performance, fuel levels, and maintenance schedules in real time.

This digitalisation enhances the overall customer experience, enabling businesses to optimise power consumption, minimise downtime, and maximise efficiency. Rental companies are increasingly investing in IoT-based solutions that provide predictive maintenance, ensuring that equipment is always operational and reducing the likelihood of unexpected failures.

Focus on Energy Efficiency and Sustainability

Energy efficiency is becoming a key consideration for power rental customers, especially in industries like construction, manufacturing, and events. Power rental companies are responding to this demand by offering more efficient, low-emission solutions.

Moreover, customers are increasingly seeking energy-efficient options that can reduce operating costs over time. This is prompting rental companies to invest in advanced power solutions that combine renewable energy with traditional generators for a more sustainable and cost-effective power solution.

Expansion of Rental Fleet and Service Offerings

To meet the growing demand for power rental solutions, rental companies are expanding their fleets and service offerings. Many companies are diversifying their services to include not just power generators but also other related equipment, such as lighting, temperature control systems, and cable management.

Expanding service offerings allows rental companies to cater to a broader range of industries, from construction to film production, and creates new revenue streams. Companies are also exploring the integration of energy storage systems, such as batteries, which can be used in conjunction with generators for improved energy management.

Market Segmentation

The UK power rental market can be segmented based on various factors, including power source, end-user, and application:

By Power Source

- Diesel Generators: Remain the most popular option for power rental due to their reliability and availability.

- Gas Generators: Gaining popularity as a cleaner alternative to diesel.

- Hybrid Power Systems: The growing trend for combining renewable energy with conventional power sources.

- Uninterruptible Power Supply (UPS): Used in critical applications that require continuous power.

By End-User

- Construction: A major consumer of power rental services for temporary power during building projects.

- Events and Entertainment: Festivals, concerts, and exhibitions rely heavily on power rental for their lighting, sound, and technical requirements.

- Manufacturing: Often requires temporary power solutions during peak periods or when upgrading equipment.

- Healthcare: Critical institutions like hospitals rely on rental power for backup during emergencies.

By Application

- Temporary Power: For short-term use in construction, events, and emergency situations.

- Backup Power: Providing power during outages to ensure business continuity.

- Peak Shaving: Used by industries to supplement power requirements during high demand periods.

Regional Analysis

The UK power rental market is primarily concentrated in urban areas with high industrial activity, such as London, Manchester, Birmingham, and Glasgow. These cities and surrounding regions represent key hubs for both construction and events, which are major consumers of rental power.

In addition to the demand in these urban areas, rural locations often require power rental solutions for projects such as agricultural works or remote construction. Moreover, the demand for renewable energy solutions is particularly high in regions with ambitious sustainability goals.

Competitive Landscape

The UK power rental market is fragmented, with several large and medium-sized players competing for market share. Key players in the market include:

- Aggreko Plc: A global leader in the power rental industry, Aggreko offers temporary power solutions across various industries, including construction and events.

- Bristol Generator Hire: A UK-based provider that focuses on temporary power rental solutions for industrial and residential sectors.

- Crestchic Ltd.: Known for providing power solutions with a focus on industrial applications and high-demand environments.

These companies are investing in fleet expansion, technology upgrades, and service diversifications to maintain their competitive edge. Additionally, partnerships with renewable energy providers and the development of hybrid systems are becoming common strategies.

Explore More:

Sonobuoy Market: https://www.expertmarketresearch.com/reports/sonobuoy-market

Tagatose Market: https://www.expertmarketresearch.com/reports/tagatose-market

Avalanche Photodiode Market: https://www.expertmarketresearch.com/reports/avalanche-photodiode-market

Future Outlook

The UK power rental market is expected to grow steadily over the next decade. The ongoing expansion of industries like construction, entertainment, and manufacturing, coupled with rising awareness about environmental sustainability, will continue to drive demand for power rental solutions.

The market is also likely to see further innovation in energy-efficient and hybrid power systems. As businesses increasingly seek greener solutions to meet regulatory requirements and reduce their carbon footprint, power rental providers will be required to invest in cleaner technologies.

With the market projected to grow at a CAGR of 3.6% between 2024 and 2032, the UK power rental market is set to reach an estimated value of USD 1,090.6 million by 2032. This presents significant opportunities for both established players and new entrants to cater to the growing demand for temporary and backup power solutions.