SharkShop Strategy for Improving Your Credit Report and Score

**Unlock Your Financial Freedom: The SharkShop Strategy for Improving Your Credit Report and Score**Are you ready to take control of your financial future but feel overwhelmed by the complexities of credit scores and reports? You’re not alone! Many people find themselves tangled in a web of myths, misunderstandings, and outdated habits that keep them from achieving their financial goals.

Enter the SharkShop.biz Strategy—a revolutionary approach designed to demystify the process of improving your credit report and elevating your score. Whether you’re aiming for that dream home, a new car, or simply want better interest rates on loans, this guide will equip you with practical tips and proven techniques to transform your creditworthiness.

Dive in as we explore how to navigate the waters of credit improvement like a savvy shark—boldly, strategically, and with confidence!

Introduction to the importance of credit reports and scores

Your credit report and score play a vital role in your financial health. They affect everything from loan approvals to interest rates on mortgages. A strong credit score opens doors to better financial opportunities, while a poor one can feel like an anchor pulling you down.

But improving your credit doesn’t have to be an uphill battle. Enter the SharkShop.biz strategy—a proven method designed not just for quick fixes but for long-term success. If you’re tired of feeling shackled by low scores or confusing reports, this guide will walk you through each step of the SharkShop approach. Get ready to take charge of your finances and navigate toward a brighter financial future!

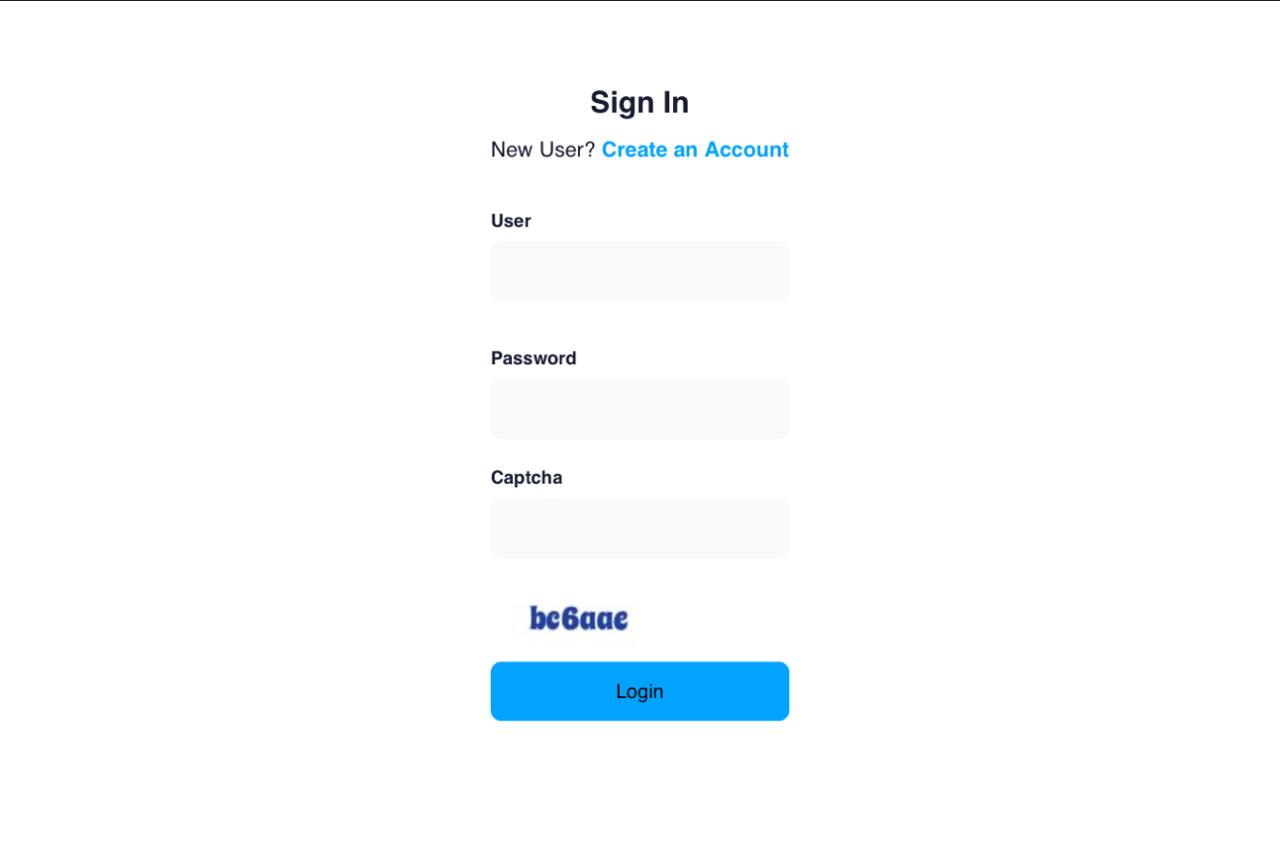

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding the SharkShop strategy: What is it and how does it work?

The SharkShop strategy is an innovative approach to improving your credit report and score. At its core, it focuses on empowering individuals with actionable steps that yield real results.

By analyzing your financial situation, you can pinpoint areas needing attention. This method emphasizes the importance of active engagement in managing debts rather than passive reliance on credit systems.

How does it work? First, you assess your current credit standing through a comprehensive review. Identifying errors or discrepancies is crucial—these can drag down your score unnecessarily.

Next, the strategy encourages negotiations with creditors for better terms. Lower interest rates or flexible payment plans can significantly ease financial burdens.

Ultimately, leveraging this structured approach helps cultivate healthier credit habits over time. Adopting these principles not only boosts scores but also fosters long-term financial stability.

Step-by-step guide for implementing the SharkShop strategy

Start by checking your credit report for errors or discrepancies. Request a free report from each of the major credit bureaus. Look closely for inaccuracies like late payments that weren’t yours or incorrect balance amounts.

Next, engage with creditors. Reach out to them and negotiate lower interest rates or revised payment plans. Many are willing to work with you if you explain your situation clearly.

Pay off high-interest debts first to save on interest costs over time. Focus on paying more than the minimum whenever possible.

Utilizing credit cards strategically is essential too. Use them for small purchases and pay the balance in full each month to build a positive history without accumulating debt.

Stay informed as you implement these steps, adjusting your approach based on what works best for your financial situation.

– Checking your credit report for errors or discrepancies

Checking your credit report is a crucial first step in the SharkShop strategy. Many people are surprised to discover errors or discrepancies that can negatively impact their score.

Start by requesting your free annual credit reports from the major bureaus: Experian, TransUnion, and Equifax. Review each report thoroughly for inaccuracies such as incorrect personal information, unfamiliar accounts, or wrong payment histories.

If you spot any issues, it’s important to act quickly. Document everything and gather supporting evidence for your claims. Then, dispute these errors directly with the credit bureau involved.

Clearing up mistakes can lead to significant improvements in your score. A clean slate means better opportunities when applying for loans or credit cards down the line. Taking this proactive approach allows you to take control of your financial future effectively.

– Negotiating with creditors for lower interest rates or payment plans

Negotiating with creditors can feel daunting, but it’s an essential step in managing your credit effectively. Start by gathering all relevant information about your debts and payment history. Knowledge is power.

When you reach out to a creditor, be polite yet firm. Explain your situation clearly—whether it’s financial hardship or recent lifestyle changes that have affected your payments.

Don’t hesitate to ask for lower interest rates or flexible payment plans. Many creditors prefer working with you rather than losing out on payments entirely.

If they decline, don’t take it personally. Consider asking what steps you might take to become eligible for better terms in the future. It shows initiative and responsibility.

Remember, persistence is key. You may need to follow up multiple times before seeing results, so keep communication open and stay organized throughout the process.

– Paying off high-interest debts first

High-interest debts can feel like an anchor, dragging down your financial progress. Prioritizing these debts is crucial for a healthier credit score and better overall finances.

When you focus on paying off high-interest accounts first, you minimize the total amount of interest you’ll end up paying over time. This strategy not only saves money but also accelerates debt repayment.

Consider using the avalanche method: list your debts from highest to lowest interest rate. Put any extra cash towards the top one while making minimum payments on others.

This approach builds momentum as each high-interest debt disappears, giving you a sense of accomplishment along the way. Plus, with lower outstanding balances, your credit utilization ratio improves—another plus for your credit report!

The relief that comes from eliminating these burdens empowers you to tackle other financial goals more effectively.

– Utilizing credit cards strategically

Credit cards can be powerful tools when used wisely. They offer convenience and rewards, but they also come with risks if not managed properly.

Start by choosing the right card for your needs. Look for options that provide cashback or travel points, aligning with your spending habits.

Next, always pay off your balance in full each month to avoid accumulating interest fees. This practice not only saves you money but also boosts your credit score.

Consider strategically using a small percentage of your available credit limit. Keeping utilization below 30% is ideal for maintaining a healthy credit score.

If possible, set up automatic payments to ensure you never miss a due date. This builds positive payment history—a significant factor in scoring models.

Lastly, periodically review your accounts to ensure you’re still benefiting from features like rewards and low-interest rates as financial situations change over time.

Tips for maintaining a good credit score

Maintaining a good credit score requires consistent habits. Start by making payments on time. Setting up automatic payments can help you stay ahead of due dates.

Next, keep your credit card balances low. Aim to utilize no more than 30% of your available credit limit. Lower balances signal responsible usage to creditors.

Be cautious with new credit applications. Each inquiry can temporarily ding your score, so only apply when necessary. Instead, focus on building positive history with existing accounts.

Regularly monitoring your credit report is essential too. SharkShop login Check for errors and dispute any inaccuracies promptly to avoid negative impacts on your score.

Lastly, maintain a diverse mix of credit types if possible—like installment loans and revolving accounts—to show lenders you can manage different forms of debt responsibly without overextending yourself.

– Making payments on time

Making payments on time is one of the simplest yet most effective ways to boost your credit score. Lenders appreciate punctuality. When you consistently meet deadlines, it signals responsibility and reliability.

Set up reminders or automate payments to ensure nothing slips through the cracks. Missing even one payment can have a lasting impact on your credit report.

Consider organizing bills in a way that prioritizes due dates. Use apps or financial tools designed for tracking expenses, which can help streamline this process further.

Even if you encounter unexpected challenges, communicate with creditors early on. They may offer flexibility or alternative arrangements to help you stay on track without damaging your credit standing.

Remember, every timely payment adds up over time, building a solid foundation for an impressive credit history.

– Keeping credit card balances low

Keeping credit card balances low is crucial for maintaining a healthy credit score. When your balance hovers around the limit, it signals to lenders that you might be overextending yourself. This can lead to higher interest rates and reduced chances of loan approval.

Aim to use no more than 30% of your available credit at any time. This strategy not only helps keep your score in check but also gives you room for emergencies or unexpected expenses without derailing your financial stability.

Consider setting up automatic payments or reminders for due dates. Consistent, timely payments prevent balances from creeping up unexpectedly while reinforcing responsible credit behavior.

If possible, pay off the full balance each month. This habit avoids interest charges altogether and boosts your standing with creditors. Making these small adjustments can have a significant impact on both your finances and peace of mind.

– Limiting new credit applications

When it comes to managing your credit score, less can often be more. Limiting new credit applications is a key strategy for maintaining financial health.

Every time you apply for a new line of credit, a hard inquiry appears on your report. Too many inquiries in a short period can signal risk to lenders and potentially lower your score.

Instead of opening several accounts at once, focus on what you truly need. This approach not only protects your score but also helps streamline your finances.

Consider waiting six months between applications if necessary. This gives each account time to mature while minimizing the impact of inquiries on your overall credit profile.

Being selective about when and where you apply demonstrates responsibility and boosts confidence among potential creditors looking at your history.

Real life success stories from individuals who have used the SharkShop strategy

Maria, a single mother, faced mounting debt after unexpected medical bills. Using the SharkShop cc strategy, she first checked her credit report for errors and found inaccuracies that boosted her score once corrected.

Next, she negotiated with creditors to lower her interest rates. This simple step made a significant difference in her monthly payments.

Jason had similar struggles but took a different approach within the SharkShop framework. He prioritized paying off his highest-interest debts first while carefully using his credit cards for essential purchases only.

Both Maria and Jason saw their scores improve dramatically over six months. Their stories highlight the effectiveness of the SharkShop strategy in transforming financial lives through practical steps and determination.

These success stories serve as inspiration for anyone looking to take control of their credit situation effectively.

Common misconceptions about improving credit scores and how to avoid them

Many people believe that checking your credit report will negatively impact your score. This is a myth. When you request your own report, it’s considered a soft inquiry and won’t affect your score at all.

Another misconception is that carrying a balance on credit cards boosts your score. In reality, keeping balances low or paying them off completely demonstrates responsible use of credit, which positively impacts your score.

Some think they can improve their scores overnight by closing old accounts. However, this can actually lower the average age of accounts and harm your overall rating.

It’s also common to believe debt settlement is an instant fix for poor scores. While it may help in some cases, settling debts often results in negative marks on reports for years to come.

Being aware of these misconceptions helps individuals make informed decisions about their financial health and improves long-term outcomes effectively.

Alternative strategies for improving your

credit score can further enhance your financial health. Beyond the SharkShop.biz strategy, consider exploring other effective methods.

One alternative is becoming an authorized user on someone else’s credit card. This can boost your score by benefiting from their positive payment history without taking on debt yourself. Another option is to set up automatic payments for recurring bills, ensuring you never miss a due date.

You might also want to explore credit counseling services which provide personalized advice and help manage your debts more effectively. Additionally, maintaining a diverse mix of credit types—like installment loans and revolving accounts—can positively impact your overall score.

Understanding these various strategies allows you to tailor an approach that best suits your needs while reinforcing the principles laid out in the SharkShop method. With dedication and informed choices, achieving a better credit report and score is entirely within reach.